Maximum Fica Withholding 2025

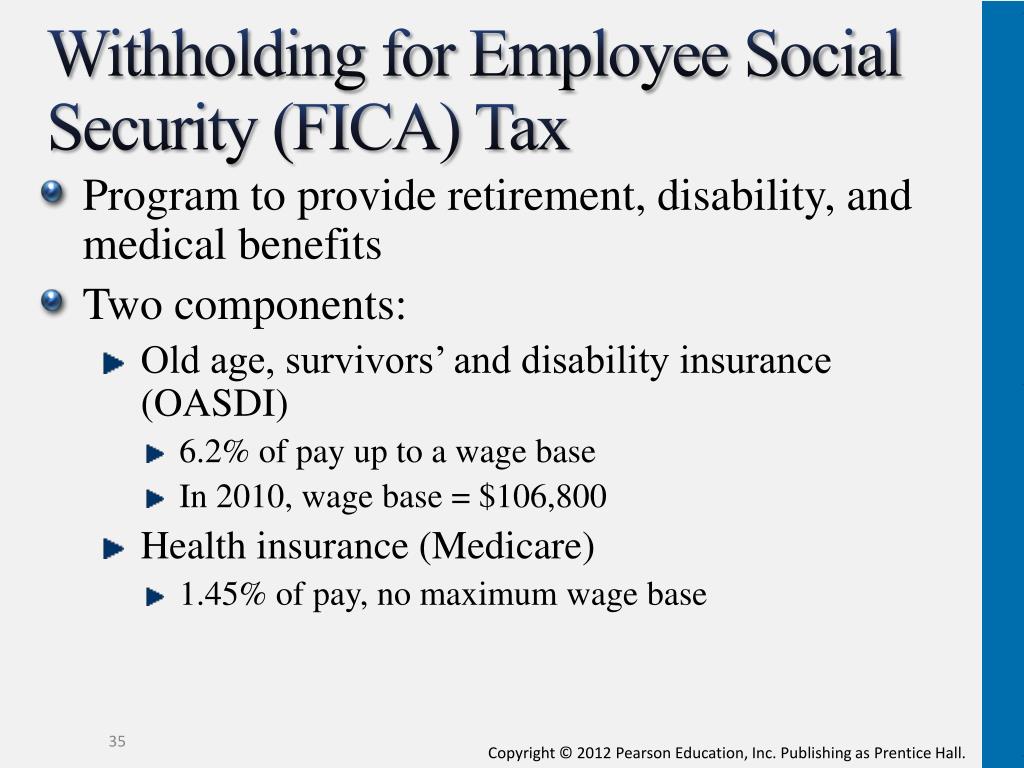

Maximum Fica Withholding 2025. In 2025, the social security wage base limit rises to $168,600. For 2025, an employee will pay:

We call this annual limit the contribution and benefit base. In 2025, the maximum taxable wage base for sdi was $153,164 and the sdi tax rate was 0.9 percent.

Maximize Your Paycheck Understanding FICA Tax in 2025, For both years, there is an additional 0.9% surtax on top of the standard 1.45%. Withholding federal income tax on fringe benefits.

What is FICA Tax? The TurboTax Blog, For 2025, the wage base was $160,200. 6.2% social security tax on the first $168,600 of employee wages (maximum tax is.

Maximum Taxable Amount For Social Security Tax (FICA), In 2025, the maximum taxable wage base for sdi was $153,164 and the sdi tax rate was 0.9 percent. In 2025, the first $168,600 is subject to the tax.

How To Calculate Fica And Medicare Tax Withholding, For 2025, the amount is $168,600, for a. 6.2% social security tax, withheld from the first $160,200 an employee makes in 2025.

How To Pay Medicare Withholding Fica Withholding, For 2025, an employer must withhold: The social security limit is $168,600 for 2025, meaning any income you make over $168,600 will not be subject to social security tax.

Here are the federal tax brackets for 2025 vs. 2025, For 2025, the amount is $168,600, for a. That money goes to the government in the form of payroll taxes.

Calculate fica and medicare withholding IanAnnaleigh, The social security wage base has increased from $160,200 to $168,600 for 2025, which increases the. However, there is no maximum income limit for the medicare portion of the.

Tax Withholding Tables For Employers Elcho Table, 2% social security tax on the first $168,600 of wages (6.2% x $168,600 makes the maximum tax $10,453.20),. For earnings in 2025, this base is $168,600.

Calculate fica and medicare withholding IanAnnaleigh, To calculate fica (federal insurance contributions act) taxes in the united states, which include social security and. However, there is no maximum income limit for the medicare portion of the.

When Is Medicare Disability Taxable, The maximum amount of social security tax an employee will have withheld from their paycheck in 2025 will be $10,453.20 ($168,600 x 6.2%). For 2025, the sdi withholding rate increases to 1.1 percent.